GEV Stock Price & Financials - GE Vernova Inc.

$323.55 (-1.40%)| freeCashFlowPerShare | 1.625 |

| marketCap | 35,710,969,350 |

| peRatio | -81.532 |

| freeCashFlowYield | 0.012 |

| payoutRatio | 0 |

| roic | -0.225 |

| Price | 183.29 |

| VolAvg | 3,092,320 |

| MktCap | 50,368,464,079 |

| LastDiv | 0 |

| industry | Renewable Utilities |

Income Statement Financials

Balance Statement Financials

Cash Flow Statement Financials

| 2024-12-31 | 2023-12-31 | 2022-12-31 | 2021-12-31 | |

|---|---|---|---|---|

| fillingDate | 2025-02-06 | 2023-12-31 | 2022-12-31 | 2021-12-31 |

| calendarYear | 2,024 | 2,023 | 2,022 | 2,021 |

| period | FY | FY | FY | FY |

| netIncome | 1,559,000,000 | -438,000,000 | -2,736,000,000 | -633,000,000 |

| depreciationAndAmortization | 1,172,000,000 | 964,000,000 | 991,000,000 | 1,176,000,000 |

| deferredIncomeTax | 316,000,000 | 342,000,000 | 157,000,000 | -349,000,000 |

| stockBasedCompensation | 0 | 0 | 0 | 0 |

| changeInWorkingCapital | 0 | 1,072,000,000 | 860,000,000 | -1,263,000,000 |

| accountsReceivables | 0 | -726,000,000 | -521,000,000 | -1,441,000,000 |

| inventory | -641,000,000 | -240,000,000 | -949,000,000 | 400,000,000 |

| accountsPayables | 1,066,000,000 | -663,000,000 | 643,000,000 | 63,000,000 |

| otherWorkingCapital | 0 | 2,701,000,000 | 1,687,000,000 | -285,000,000 |

| otherNonCashItems | -464,000,000 | 3,145,000,000 | 3,580,000,000 | 2,390,000,000 |

| netCashProvidedByOperatingActivites | 2,583,000,000 | 1,186,000,000 | -114,000,000 | -1,660,000,000 |

| investmentsInPropertyPlantAndEquipment | -883,000,000 | -744,000,000 | -513,000,000 | -577,000,000 |

| acquisitionsNet | 0 | 60,000,000 | 53,000,000 | 69,000,000 |

| purchasesOfInvestments | -114,000,000 | -83,000,000 | -393,000,000 | -545,000,000 |

| salesMaturitiesOfInvestments | 244,000,000 | 232,000,000 | 340,000,000 | 176,000,000 |

| otherInvestingActivites | 716,000,000 | -199,000,000 | 191,000,000 | -264,000,000 |

| netCashUsedForInvestingActivites | -37,000,000 | -734,000,000 | -322,000,000 | -1,141,000,000 |

| debtRepayment | -23,000,000 | -16,000,000 | -15,000,000 | -104,000,000 |

| commonStockIssued | 0 | 0 | 0 | 0 |

| commonStockRepurchased | 0 | 0 | 0 | 0 |

| dividendsPaid | 0 | 0 | 0 | 0 |

| otherFinancingActivites | 3,675,000,000 | -424,000,000 | 796,000,000 | 2,100,000,000 |

| netCashUsedProvidedByFinancingActivities | 3,652,000,000 | -408,000,000 | 811,000,000 | 1,996,000,000 |

| effectOfForexChangesOnCash | -147,000,000 | 22,000,000 | -87,000,000 | -66,000,000 |

| netChangeInCash | 6,051,000,000 | -516,000,000 | 267,000,000 | -871,000,000 |

| cashAtEndOfPeriod | 7,602,000,000 | 1,551,000,000 | 2,067,000,000 | 1,800,000,000 |

| cashAtBeginningOfPeriod | 1,551,000,000 | 2,067,000,000 | 1,800,000,000 | 2,671,000,000 |

| operatingCashFlow | 2,583,000,000 | 1,186,000,000 | -114,000,000 | -1,660,000,000 |

| capitalExpenditure | -883,000,000 | -744,000,000 | -513,000,000 | -577,000,000 |

| freeCashFlow | 1,700,000,000 | 442,000,000 | -627,000,000 | -2,237,000,000 |

| link | https://www.sec.gov/Archives/edgar/data/1996810/000199681025000011/0001996810-25-000011-index.htm | |||

| finalLink | https://www.sec.gov/Archives/edgar/data/1996810/000199681025000011/gev-20241231.htm |

GE Vernova Inc.

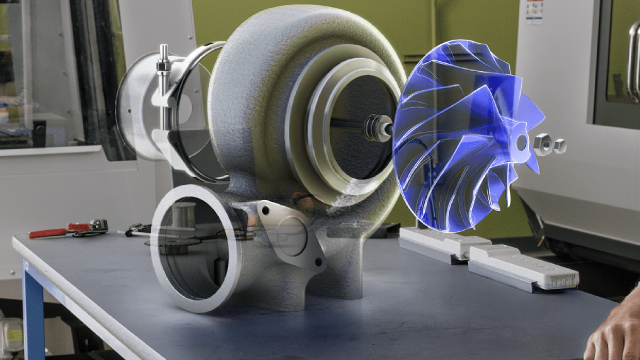

Description: GE Vernova LLC, an energy business company, generates electricity. It operates under three segments: Power, Wind, and Electrification. The Power segments generates and sells electricity through hydro, gas, nuclear, and steam power. Wind segment engages in the manufacturing and sale of wind turbine blades; and Electrification segment provides grid solutions, power conversion, solar, and storage solutions. The company was incorporated in 2023 and is based in Cambridge, Massachusetts.

Website:https://www.gevernova.com

Industry: Renewable Utilities

Sector: Utilities

CEO:

Full-Time Employees: 80000

Address: 58 Charles Street, Cambridge, MA, 02141, US

Phone: 617 674 7555

Currency: USD

CIK:

ISIN: US36828A1016

CUSIP:

Exchange: New York Stock Exchange

Exchange Short Name: NYSE

IPO Date: 2024-03-27

| Ticker | peRatio | enterpriseValueOverEBITDA | evToFreeCashFlow | roic | netCurrentAssetValue | bookValuePerShare | priceToSalesRatio | netIncomePerShare |

|---|---|---|---|---|---|---|---|---|

| GEV | -81.53 | 73.02 | -0.22 | -11,367,000,000.00 | 27.26 | 1.07 | -1.61 |

Analyst Estimates

Latest News

GE Vernova (GEV) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

GE Vernova (GEV) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Is Wall Street Missing The Real Growth Story Inside GE Vernova (Rating Upgrade)

GE Vernova has shifted from a messy spin-off story to a more focused and disciplined energy business. Electrification is becoming the company's most reliable and profitable segment, with strong demand and margin potential. Wind remains a risk, but restructuring efforts and U.S. incentives are improving the outlook.

GE Vernova to Boost Germany's Wind Power: Should You Buy the Stock Now?

Investors interested in GEV stock should wait for a better entry point, considering its premium valuation.

GE Vernova Declares Second Quarter 2025 Dividend

CAMBRIDGE, Mass.--(BUSINESS WIRE)--GE Vernova (NYSE: GEV) today announced that its Board of Directors has declared a $0.25 per share quarterly dividend. The quarterly dividend will be payable on May 16, 2025, to shareholders of record as of April 18, 2025. Future dividend declarations will be made at the discretion of the Board of Directors and will be based on GE Vernova's earnings, financial condition, cash requirements, prospects, and other factors. Additional Information GE Vernova's websit.

2 Top Energy Stocks to Buy in April for Long-Term AI Growth: CEG, GEV

Diving into two top energy stocks to buy in April for long-term AI growth: GE Vernova and Constellation Energy.

GE Vernova to supply turbines by 2026 for planned natgas power plant in Pennsylvania

GE Vernova will aid in turning Homer City Generating Station — previously a coal-power plant in Pennsylvania — into a natural gas-powered data center campus by providing seven turbines to produce nearly 4.5 gigawatts (GW) of power.